The entity uses a purchase journal only when it uses a manual to record accounting information. However, if an entity uses an accounting system to record its accounting and financial information, a purchase journal is not required. It can help you track the expenses of your business, which can be useful for tax purposes. It can also help you keep an accurate inventory of the products and services you offer. This can be helpful if you need to recall a product or service, or if you are considering expanding your offerings.

Journal Entry

Once the purchasing department confirms that goods have been received, the invoice goes to accounts for payment. Inventory purchases represent the acquisition of goods that a business intends to sell. These transactions not only affect the company’s current assets but also have implications how to invoice as a contractor for its cost of goods sold (COGS) and, ultimately, its gross profit. The debit to the Inventory account shows an increase in assets, as the company now has more inventory. The credit to the Cash account decreases the company’s cash on hand, reflecting the payment for the inventory.

Components of a Inventory Purchase Journal Entry

And it is normally prepared only if the entity has a lot of purchases on credit transactions. Yes, purchasing inventory is recorded as an increase in assets (Inventory account) because it adds physical stock that the company intends to sell for a profit. When inventory is purchased on credit, the Inventory account on the balance sheet increases, reflecting more assets, and the Accounts Payable account also increases, indicating a rise in liabilities.

Explanation for Credit Purchase

Purchase journals are special journals used by an organization to keep track of all the credit purchases. While credit transactions are recorded in the Purchase book, cash purchases are entered in a general journal. It is worth mentioning that only the credit purchase of goods is recorded in such journals, and any capital expenditure is excluded. Since the purchases journal only records credit transactions, none of the cash transactions made during the period are posted in it. Instead, all cash inventory and supply purchases are recorded in the cash disbursements journal.

- If the purchase is made in cash, credit the Cash account to decrease the company’s cash on hand, showing that cash has been spent to acquire inventory.

- The cash receipts journal is used to record all receipts of cash for any reason.

- By meticulously recording inventory purchases, a business can maintain accurate financial records, essential for analyzing its financial health, making informed decisions, and reporting to stakeholders.

- The Times maintains several regional bureaus staffed with journalists across six continents, and has received 137 Pulitzer Prizes as of 2023, the most of any publication, among other accolades.

- This increases the inventory, reflecting the addition of gardening tools.

This credit transaction would be recorded by debiting inventory and crediting accounts payable for $100. The first is a debit from an expense account and the second is a payment to the company or service provider. Businesses often have expense accounts set up to make budgeting easier.

Double entry related to credit purchase for resalable purpose

Most organizations have a separate purchase department responsible for the procurement of goods. So, when any person or department needs any goods, they have to send a request to the Purchase department; if the goods are already available in the stock or warehouse, the purchasing department will issue the goods. If the goods are not available, the purchasing team will identify the supplier who specializes in needed goods, and they will place the order. Once the order has arrived, they will check that it matches the required description and quantity matches what was requested.

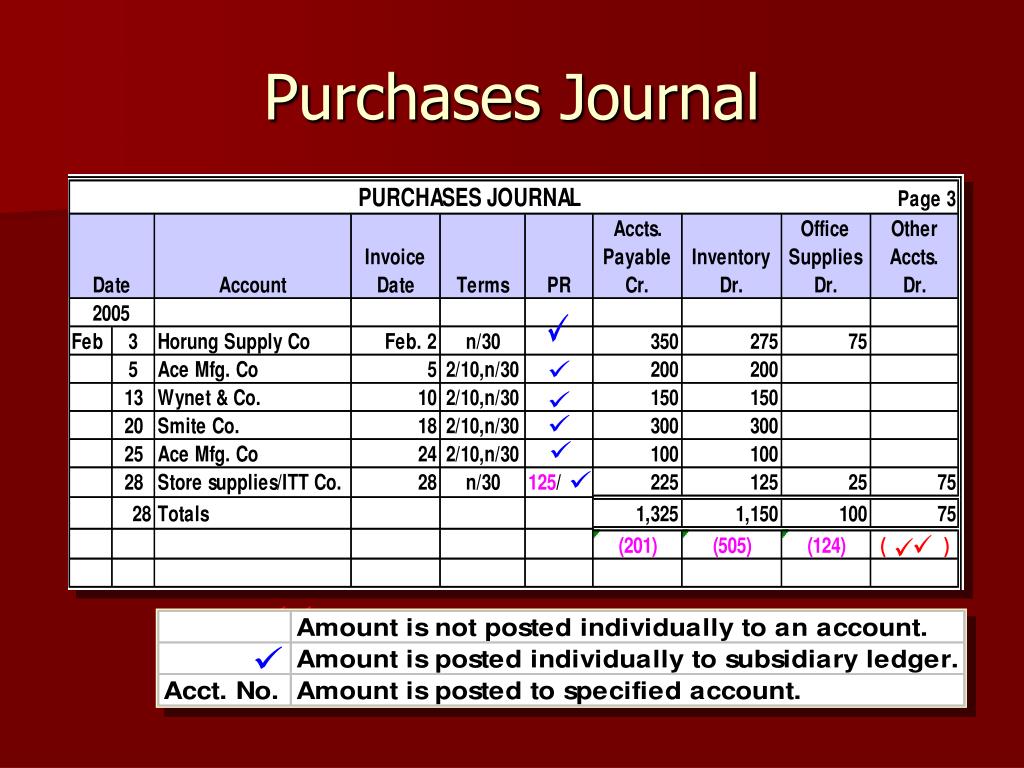

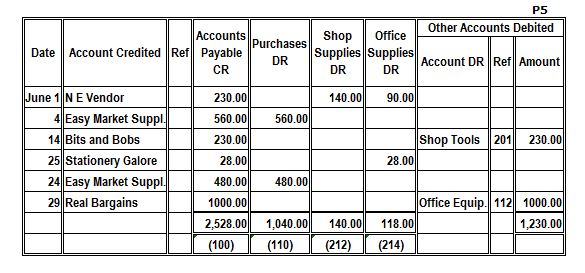

Journal aggregation means that you summarize a period of spending from a purchase journal and add it as an entry to the general journal ledger. A purchases journal is a special journal used to record any merchandise purchased on account. The entries in this journal are made based on the invoice received from the supplier on the purchase date.

In the 21st century, The New York Times has shifted its publication online amid the global decline of newspapers. By meticulously recording inventory purchases, a business can maintain accurate financial records, essential for analyzing its financial health, making informed decisions, and reporting to stakeholders. Debiting the Inventory account increases Garden Supplies Co.’s assets, as it adds value to the company’s stock. Crediting the Accounts Payable account increases the company’s liabilities, showing that the purchase will be paid for at a later date, not immediately impacting the company’s cash flow. At the end of the period, the TOTALS only would be recorded in posted directly into the accounts listed with no journal entry necessary.

Then the supplier will issue a Credit Note document, which will be adjusted against the payments of goods in the future. For example, X Ltd. returned goods worth $1,000, and Y Ltd. issued a credit note for that value. So next time X Ltd. will purchase $5,000, it only has to pay $4,000 as $1,000 will be adjusted against credit note. The method of payment (cash or credit) influences which accounts are involved in the transaction. This account will be credited with every transaction we record in this journal.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Finally, at the end of the month, a list of the individual subsidiary accounts is created.

Auditors routinely engage in this activity when they are verifying transactions that have been posted to the general ledger. All of the purchase on credit transactions are posted to this journal on an order-by date. And all you need to enter are the date, name of suppliers, supplies accounts, invoices identification, description of transactions, and amounts. At the end of the month, the amount column in the journal is totaled, and this amount is posted as a debit in the general ledger purchases account.