Content

Input invoices into the procurement and account payable software systems. P2P is also known as purchase-to-pay, eProcurement, and sometimes by the rhyming phrase, req2check.

Fitch Downgrades Evergrande and Subsidiaries, Hengda and Tianji, to Restricted Default – Fitch Ratings

Fitch Downgrades Evergrande and Subsidiaries, Hengda and Tianji, to Restricted Default.

Posted: Thu, 09 Dec 2021 07:59:00 GMT [source]

These are written agreements in which the borrower obtains a specific amount of money from the lender and promises to pay back the amount owed, with interest, over or within a specified time period. It is a formal and written agreement, typically bears interest, and can be a short-term or long-term liability, depending on the note’s maturity time frame. Analysts and creditors often use the current ratio which measures a company’s ability to pay its short-term financial debts or obligations. The ratio, which is calculated by dividing current assets by current liabilities, shows how well a company manages its balance sheet to pay off its short-term debts and payables. It shows investors and analysts whether a company has enough current assets on its balance sheet to satisfy or pay off its current debt and other payables. The current ratio measures a company’s ability to pay its short-term financial debts or obligations.

What Is A Notes Payable?

This gives the business the funding it needs without relinquishing any control over how those funds are used and without the need to get pre-approval from its investors. It makes forward planning easy, so budgeting to handle the eventual repayment is smooth.

- Because AP and NP are both documented as liabilities on a balance sheet, people are often confused by their differences.

- The notes payable account in the general ledger keeps a record of all the promissory notes a company issues to lenders of funds or vendors of assets.

- Proven track record in meeting leadership, management and team objectives.

- A number higher than one is ideal for both the current and quick ratios since it demonstrates there are more current assets to pay current short-term debts.

- The amount owed on long-term financing appears under the long-term liabilities section of the balance sheet.

Note payable is a liability of an individual or organization, evidenced by a written promissory note to pay by a specific amount by a specific date. The promissory note may also specify interest charges, any collateral involved, and penalties for late payment. The note becomes an active, binding legal obligation at the moment the borrower signs the agreement. It is also incur interest which is treated as an expense and is listed on both profit and loss as well as cash flow statement. A distinguishing characteristic of notes payable is that it is termed as a promissory note. These are also critical in terms of payment schedule while also being interest bearing component.

Notes Payable Vs Accounts Payable

Although the current and quick ratios show how well a company converts its current assets to pay current liabilities, it’s critical to compare the ratios to companies within the same industry. Also, a note payable may require collateral as security for the loan. Discount amortization transfers the discount to interest expense over the life of the loan. This means that the $1,000 discount should be recorded as interest expense by debiting Interest Expense and crediting Discount on Note Payable. In this way, the $10,000 paid at maturity will be entirely offset with a $10,000 reduction in the Note Payable account .

on that note, hiring a chief mind distributor for @0xe6y. pls enquire ✨within ✨

— elliex.eth 🌸🌈☀️ (@heyellieday) December 5, 2021

comp payable in $ELLIE (and other valuable tokens*)

*$ELLIE is a valueless utility token 😇 https://t.co/WGyjl1um20

And they spend an extraordinary amount of time trying to ensure data from invoices are keyed into their system accurately. Notes payable is a liability account maintained in a company’s general ledger that tracks their promises to pay specific amounts of money within a predetermined period. For example, most companies use the services of manufacturing plants in China to assemble their products. Pending service payments to these plants would be marked under the company’s accounts payable. Debts marked under accounts payable must be repaid within a given time period, usually under a year, to avoid default.

How To Get Rid Of The Notes Tab In Facebook

Notes payable are classified as current liabilities when the amounts are due within one year of the balance sheet date. When the debt is long‐term but requires a payment within the twelve‐month period following the balance sheet date, the amount of the payment is classified as a current liability in the balance sheet. The portion of the debt to be paid after one year is classified as a long‐term liability. The most common current liabilities found on the balance sheet include accounts payable, short-term debt such as bank loans or commercial paper issued to fund operations, dividends payable. The notes payable account in the general ledger keeps a record of all the promissory notes a company issues to lenders of funds or vendors of assets. Because the notes payable is a liability account, the normal course of entry is crediting notes payable, and debiting cash or another asset received against it. On the maturity date, the organization has to pay the principal amount plus the interest at the rate mentioned in the note.

Notes payable支払手形

— 会計英語bot (@eigo_de_kaikei) December 4, 2021

You can find your Notes Payable in the liabilities section of your balance sheet. Depending on when you plan to pay off the principal balance, it will be labeled as a current or long-term liability.

Creating An Enforceable Promissory Note

In the promissory note, the borrower promises a certain amount of principal money plus any interest thereon at a certain date specified in the future. If a company borrows money from its bank, the bank will require the company’s officers to sign a formal loan agreement before the bank provides the money. The company will record this loan in its general ledger account, Notes Payable. In addition to the formal promise, some loans require collateral to reduce the bank’s risk.

SuRo Capital Corp. Prices Public Offering of $70000000 6.00% Notes Due 2026 – The Bakersfield Californian

SuRo Capital Corp. Prices Public Offering of $70000000 6.00% Notes Due 2026.

Posted: Thu, 09 Dec 2021 22:53:24 GMT [source]

The cash payment included $400 for interest, half relating to the amount previously accrued in 20X8 and half relating to 20X9. When payments are made on the bank note principal , the Notes Payable account will be debited to reflect the amount remaining to pay off the loan. While the concepts discussed herein are intended to help business owners understand general accounting concepts, always speak with a CPA regarding your particular financial situation. The answer to certain tax and accounting issues is often highly dependent on the fact situation presented and your overall financial status. The content provided on accountingsuperpowers.com and accompanying courses is intended for educational and informational purposes only to help business owners understand general accounting issues. The content is not intended as advice for a specific accounting situation or as a substitute for professional advice from a licensed CPA.

Free Accounting Courses

The amounts of money involved are often much higher and for riskier investments, like buying a new business property. Notes payable often represent significant borrowing for long-lived assets such as buildings, equipment, and other costly infrastructure. This typically happens if a company decides it’s unable to fulfill its short-term debt obligations. Accrued interest may be paid as a lump sum when the full amount is due or as regular payments on a monthly or quarterly period, depending on the settled terms. Larger obligations, such as pension liabilities and capital leases, are instead usually tracked under long-term liabilities.

For instance, a bank loan to be paid back in 3 years can be recorded by issuing a note payable. The nature of note payable as long-term or short-term what is notes payable liability entirely depends on the terms of payment. The analysis of current liabilities is important to investors and creditors.

What Are Some Current Liabilities Listed On A Balance Sheet?

Here, we will debit it because there will be no liability anymore once the full amount is being paid off. We will also debit the interest payable because a portion of interest was due, but not now. Total liabilities for August 2019 were $4.439 billion, which was nearly unchanged when compared to the $4.481 billion for the same accounting period from one year earlier.

Interest must be calculated using an estimate of the interest rate at which the company could have borrowed and the present value tables. The present value of the note on the day of signing represents the amount of cash received by the borrower. The total interest expense is the difference between the present value of the note and the maturity value of the note. Discount on notes payable is a contra account used to value the Notes Payable shown in the balance sheet. Long-term debt includes obligations with payment periods commonly ranging from just over 12 months up to 30 years.

Notes Payable On Balance Sheet

A note payable is classified in the balance sheet as a short-term liability if it is due within the next 12 months, or as a long-term liability if it is due at a later date. When a long-term note payable has a short-term component, the amount due within the next 12 months is separately stated as a short-term liability. Notes payable contain an interest rate on the amount of principal.

What is a note fund?

Note Fund investing technically means investing in shares of a privately-held company like PPR that manages a portfolio of mortgages (aka notes), but participating in a note fund really means investing in the company managing the fund.

Appointment Scheduling 10to8 10to8 is a cloud-based appointment scheduling software that simplifies and automates the process of scheduling, managing, and following up with appointments. Chris Kolmar is a co-founder of Zippia and the editor-in-chief of the Zippia career advice blog.

These limitations may include restrictive covenants such as not paying dividends unless the promissory note has been settled. The company should also disclose pertinent information for the amounts owed on the notes. This will include the interest rates, maturity dates, collateral pledged, limitations imposed by the creditor, etc. Account Title Debit Credit Cash $5,000 Notes Payable $5,000 Then, the interest amount of $50 will be recorded as a debit to interest payable and as a credit to the cash account.

- Promissory notes usually specify a given maturity date, interest rate, and any collateral.

- As the seller of the product or service earns the revenue by providing the goods or services, the unearned revenues account is decreased and revenues are increased .

- When a Business owes someone money, they have essentially created a Liability for themselves since the amount needs to be repaid at a later date.

- Notes Payable and Accounts Payable are different because Notes Payable are based on written promissory notes, while Accounts Payable are not.

- Current assets are a balance sheet item that represents the value of all assets that could reasonably be expected to be converted into cash within one year.

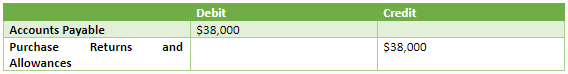

Since they’re not written agreements, the terms can be changed on the agreement between the vendor and the business entity. Account payables are not written agreements or promise to pay the money on a certain date. However, the notes payable are written agreement with a certain due date and payment terms. The treatment of notes payable can vary depending upon the standards of accounting and company norms. However, notes payable are always mentioned as liabilities on the balance sheet. Many companies are fine with the risks involved when they give short-term credit to their trusted customers. If a customer doesn’t meet the due date of their accounts payable agreement, the company might choose to then form a notes payable giving the customer more time to pay, but now with interest charged.

For a small business or a startup, notes payable may be a way to get off the ground, even if they’re just borrowing a small amount of money. On the other hand, accounts payable typically represent amounts due to suppliers and vendors of a company. The $40 monthly interest would be recorded as a credit to the cash account and as a debit to interest payable. This borrowed cash is typically used to fund large purchases rather than run a company’s day-to-day operations. To run their day-to-day business operations, companies often take on short-term liabilities to maintain an adequate amount of working capital. A promissory note generally specifies the interest rate, maturity date, collateral, and any limitations imposed by the creditor or the lender.